Using Data for Manual Review Targeting and Resolution

April 14, 2022

Table Of Contents

This article is part 6 of our ongoing identity series. To read the previous blog, click here. To read part 1, click here.

What is Manual Review?

Automation has greatly accelerated the process of identifying and verifying qualified applicants and claims, but technology alone isn’t sufficient to manage every case.

The process of manual review is an inspection performed by qualified agents who can detect inconsistencies and patterns that aren’t resolved via automation or apparent in data alone. Automated systems can quickly manage obvious high-risk or low-risk situations, but there are gray areas where a person’s intuition and insight can’t be replaced.

Businesses benefit from greater efficiency when they’re able to reduce the number of cases that need to go to manual review, and/or reduce the amount of time required to resolve pending cases through their manual review process. In doing so, they conserve resources and increase customer satisfaction. More efficient resolutions also allow businesses to focus on the cases that involve the highest risk rather than waste time reconciling redundant cases.

The one constant through each phase, automated processes or human manual review, is data. Data is a reflection of reality, so systems will always need human agents that are grounded in reality to assess context that machines may miss.

In manual review, there are 3 steps:

Targeting

Resolution

Determination

In this installment of our ID series, we will cover targeting and resolution.

Targeting and Resolution

Automated fraud detection solutions sometimes return inconclusive results, or “targets”. In such cases, a human may need to manually verify the target to confirm identity, clarify if the claim is legitimate, investigate if the identity is synthetic, etc. This is often done in conjunction with external tools or internally created systems, and in compliance with rules and regulations specific to the industry in question.

Human beings play a key role in identifying and resolving things that don’t make sense. For instance, a person filing for a large business loan using their personal accounts or email, rather than accounts and addresses connected to that business, is the type of anomaly that may raise red flags that require manual review to resolve.

Challenges of Manual Review

Although necessary, too many cases of manual review can slow down approval processes for legitimate inquiries and negatively impact customer retention. Most businesses try to reduce the number of cases that need to go to manual review, and/or reduce the amount of time it takes to resolve pending manual review cases.

The costs incurred by your business in a manual review are highly opportunistic. Yes, time spent doing manual review can be spent elsewhere, but also only the most complex issues should be brought to manual review. Depending on the industry, up to 26% of records have been reported requiring manual review. Experts conducting manual review need all the contextualization they can get from quality data and automated systems. The cost of manual review is not just what you need to pay the investigators, but there is also added friction, delays in other operational pipelines, and many other factors that threaten a positive customer experience.

Manual review isn’t likely to go away, but the sophistication and depth of ML/AI models will change how businesses approach and utilize manual review into the future.

Improving Manual Review with Data

The quality of your manual review process is a direct function of the data you funnel into your automated systems and manual inspections. The better and more relevant the data, the better your decision making capability on both ends of the review system.

Data is important in targeting and resolution, as manual reviewers need the right information on the right people to get to the truth. But, reviewers also need the right information to inform their various tools and processes. Automated systems can better ingest claims and orders while their targets become more contextualized. With the right data, less unnecessary claims are passed through automated tools, less time is spent per manual review, and more resources can be dedicated to high-risk targets. This improves operational efficiency with proactive fraud detection and improved customer satisfaction brought with a swift review period.

Note that feedback can also be collected from manual reviewers to engineer features, such as weighting, in rules-based/machine learning processes. For example, if common work history is usually found between two identities that historically yielded a red flag target, a rule can be designated to automate away many of the erroneous flags occurring from past coworkers doing business.

Conducting Manual Review with People Data Labs

Superior B2B data, like that provided by People Data Labs, drastically improves the efficiency of the manual review process.

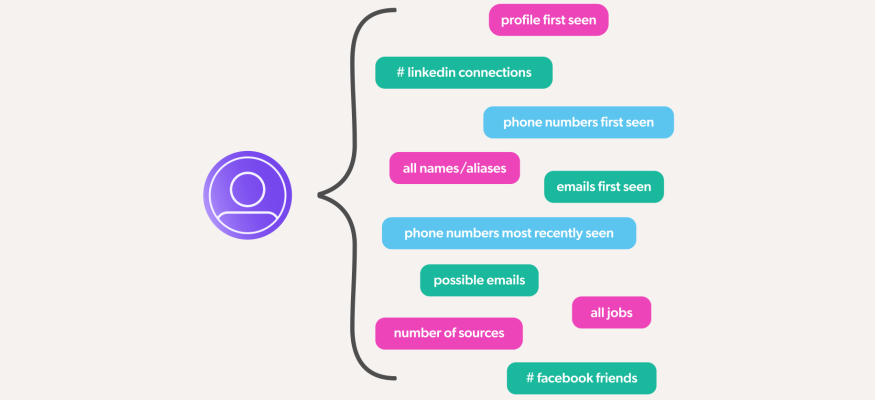

Our Identify API allows users to quickly identify and verify identities against a massive dataset comprising millions of person profiles. If a claim or instance features characteristics of multiple identities, we can return the most likely identities fitting your request to asses if it is legitimate or not. If not very strong results are returned, that’s a strong indication that the identity is fraudulent.

In addition, you can distinguish each identity’s risk based on a large variety of parameters specific to your business, like number of sources or LinkedIn connection. This allows you to look at a record with proper data and view a targeted identity from multiple angles.

Our data becomes most impactful when it is pipelined into external or in-house tools that manual review teams utilize.

We’d love to work with you to make your manual review process as intuitive as possible. Schedule a consultation or try our free API key to get started!

Like what you read? Scroll down and subscribe to our newsletter to receive monthly updates with our latest content.