Implementing a Data-Driven Strategy to Drive Investment Intelligence | Webinar Recap

January 10, 2023

We recently hosted a webinar with several People Data Labs (PDL) experts where we spotlighted insights that PDL data can easily produce and discussed various use cases for data within the Financial Services and Investment space.

If you like what you read here, we encourage you to watch the on-demand version.

Fintech is a massive and still-growing industry. This growth and new-frontier nature of the industry has created large pain points that can be addressed with high-quality data.

According to Forrester, the downturn of the economy will shift consumer payment habits, and according to Qualiket research cited on businesswire, the worldwide Banking-as-a-Service Industry alone is expected to reach $73.5 Billion by 2027. So, there’s a lot of change and opportunity on the road ahead.

The key to Fintech and investment success is understanding the data around people and companies that operate within the economy.

Data Innovation at the Forefront of Fintech Success

We asked our attendees to detail what goal(s) they wanted to address from attending the webinar. The responses were intriguing, and kicked of our first points of discussion:

Create better data-driven investment tools and applications: 72%

Identify fast-growing standouts within an industry or sector: 45%

Deep dive into specific opportunities or portfolio companies: 45%

Track key talent flows between competitor organizations: 18%

Based on these results, it’s evident that innovation is still at the forefront of many businesses' objectives. Identifying standout companies and diving into the data is still important (being tied for 2nd place), but most companies in this competitive field are most concerned with outplaying the competition and winning a slice of the market. As we’ve also seen in our deconstructing webinar series, product-led growth and attention is a high priority and recurring trend with many successful companies today.

How People Data Labs Powers Investment and Fintech Innovation

Our data is all built on our foundation of compliantly sourced data containing over 3 billion person profiles. This includes 184 million records in the US, which is about the entire US population, and over 20 million company profiles. We can apply unique layers to draw interesting insights. This involves running aggregations and finding insights on talent movement, company expertise, growth rates, term rates, etc.

PDL also has a strong pedigree of customers of over 400 companies using this data specifically within the investment space. This includes 5 out of the top 10 Venture Capital firms by AUM. Through this experience, we’ve seen some trends and use cases that allow us to be consultative when working with these types of firms to quickly identify and fix problems.

We’ve been privileged to help tailor solutions and enable data teams to build out workflows so deal teams and investment managers can use this data to find insights, and more importantly, take action.

There are 3 main use cases within investment research that were covered in the webinar:

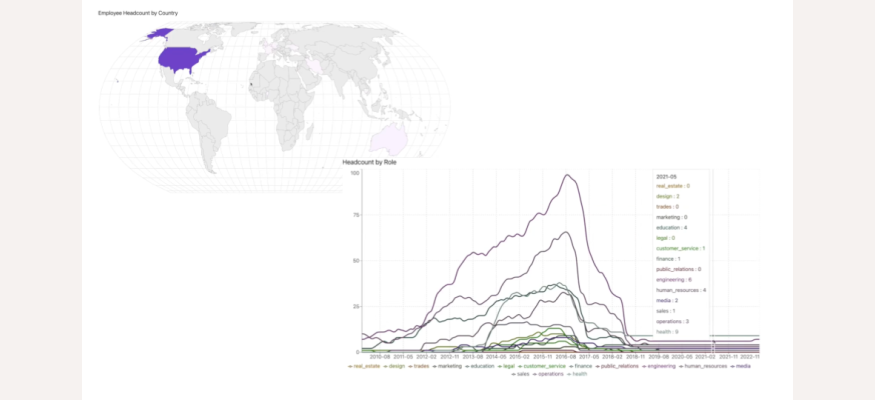

Generating short ideas: key executive departures, employee churn rates, employee sentiment, layoffs and restructurings, and data aggregation by time period, such as month, for ease of analysis.

Identifying growth signals early: employee growth and positive and negative momentum indicators of competitive companies.

Powering bottom-up model assumptions: revenue models using assumptions based on true historical employee counts by job role.

In this webinar, we feature an overview of our investment intelligence data that was combined with outside sources. We also built a dashboard to more easily view the data.

In the Q&A section of the webinar, Sam Rounds, Senior Product Manager, Data, remarked, “The mind starts to overwhelm at all of the different use cases for this. It’s really inspiring because the same type of data is often used for building and understanding of a market or industry segment in terms of calculating Total Addressable Market, making challenging decisions in the diligence stage of an investment, investigating company growth, building operating financial models, forming accurate cost models, and more.”

Again, if you are intrigued by what you read here, watch the on-demand webinar to get more insight and information, or contact us if you would like a free consultation.