Sharing Economy Unicorns: Data on How they Grew their Teams

November 18, 2022

Understanding departmental change through a company’s early beginnings can significantly inform strategy for investing, navigation in competitive markets, hiring/recruiting, and much more.

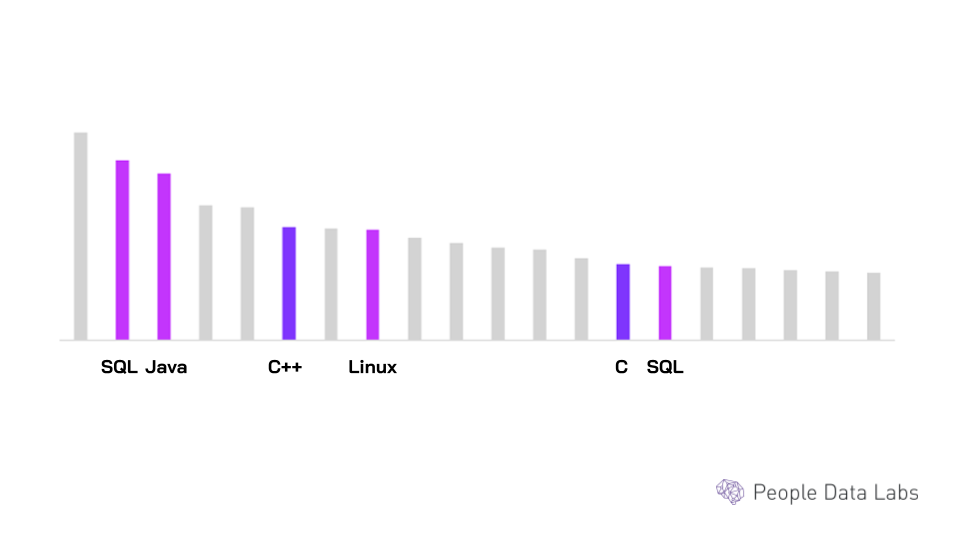

Inspired by this post by David Sacks on the SaaS Org Chart, we looked into our data on the four companies, Uber, Doordash, Airbnb and Lyft, to see what job areas they focused on at various stages of funding. We started with the percentage of the total company headcount represented by each department at each round of fundraising.

The four companies had surprisingly similar department size ratios in the months they raised their respective Series D rounds. Customer Service comprised between 6% and 10% of total employees, and engineering comprised between 16% and 18% of total employees.

The big standout is Doordash’s emphasis on Sales versus Uber, Airbnb, and Lyft’s focus on Marketing.

Looking at Doordash’s department size ratio through 5 of its fundraising rounds, A through E, we see that its focus on Sales increased as it grew, particularly from Series B to D.

This seems to represent a shift away from Customer Service and Marketing. Through that time period, as the entire company grew by nearly 700%, Sales grew by 2,100%, while Customer Service team only grew by 200% and Marketing grew by 350%.

Airbnb’s department size ratio data shows a similar Series B to D shift, but in this case, away from Marketing, Sales, and Customer Service to Engineering, Design, and Operations. Is this evidence of a pivot towards product-led growth to achieve scale?

Our data on Uber shows several shifts, including an interesting move away from Design and Engineering to customer service. This could be the result of a simple app that once launched, is only updated incrementally compared to the customer service challenges of scaling a large B2C customer base.

Deconstructing Uber, Doordash, AirBnB and Lyft using our data, we see that these unicorns competing in their shared market each had different areas of relative focus along the way, yet each has been successful in growing their businesses through the years. Perhaps if one of them had access to PDL data along the way, their journey would have been less volatile.

The insights above were compiled using People Data Labs’ data. Click here for our free datasets, ebooks, case studies and reports. Or, signup today for a free API key to access our data today.